My Cost Basis vs. My Adjusted Basis

Wherein I describe what the difference between these two are.

After sending out my trades for this week yesterday, I got some questions about what I meant by my adjusted cost basis. I thought I’d answer those today.

To track all my trades, I use a couple different tracking sheets.

One is a simple passive income tracker. This is where my monthly numbers come from.

I use this sheet to get an idea of how much money I am making each month and each trade.

Currently, my average return on each trade is 3.04%. My goal is to keep each trade above 1%. If I do that, I’ll keep making good money.

I use another tracker called The Wheel Tracker, which tracks my trades across time on each specific stock.

This tracks how much I have made from puts, calls, and assignments.

This is from the book I have recommended before called “The Options Wheel Strategy: The Complete Guide To Boost Your Portfolio An Extra 15-20% With Cash Secured Puts And Covered Calls”

You can get that book and get a link to the same tracking sheet that I use.

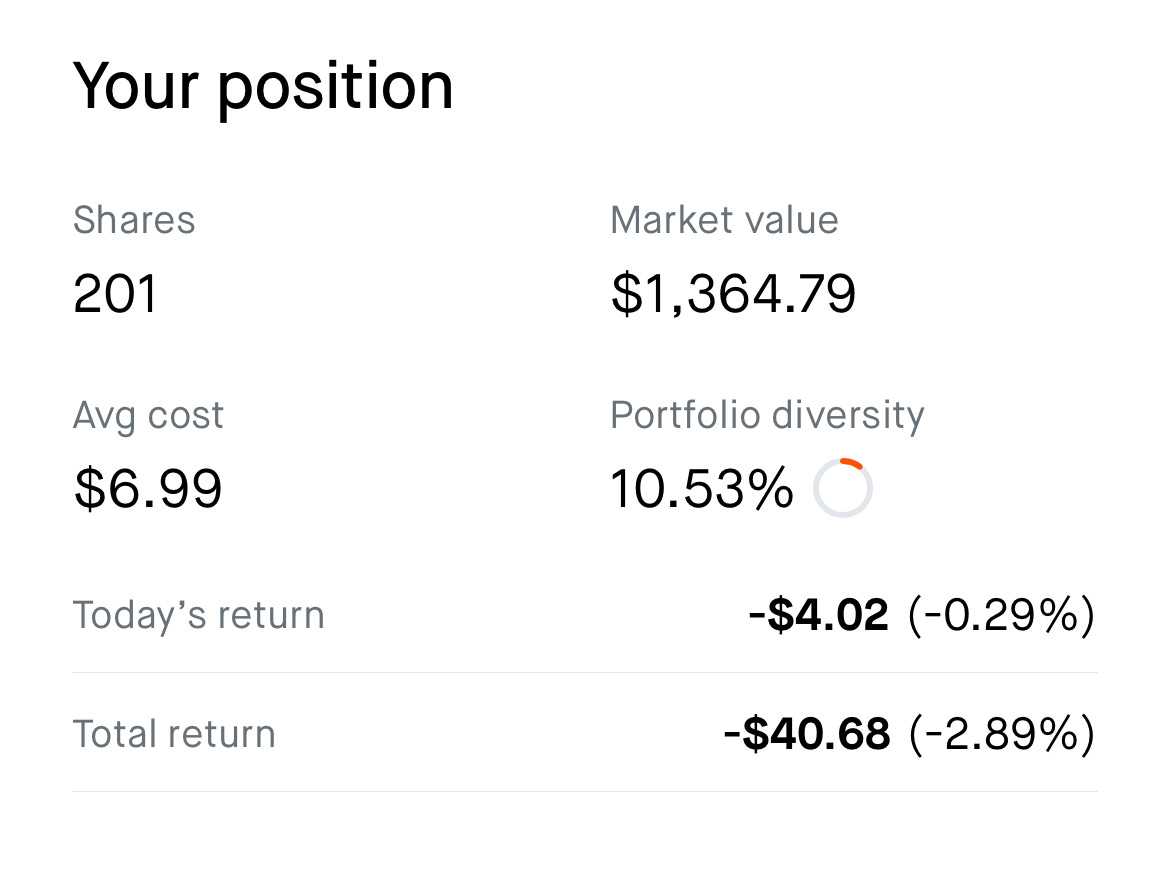

Anyway, the red box in the image above shows how much I have paid for a given stock. This example is SOFI 0.00%↑ which I just started doing something with. It is showing that I have total credits of $90, which is how much I have made from selling calls and puts. And it is showing that I have been debited $1400 on this stock by buying 200 shares after a put was assigned.

So, my adjusted cost basis for this stock is different than what my actual cost basis is for the stock I recently bought at $7.

The cost basis is how much I paid for the stock: $7.

My Adjusted Basis is how much I can sell the stock for to break even.

When I look in Robinhood at SOFI 0.00%↑ I see that I have an average cost (also called cost basis of $6.99. I have one share that I bought for ~$4.75 or so. The other 200 shares are from the options events.

Let’s look at another stock. A lot of money has changed hands with RUM 0.00%↑ .

You can see that I have total credits of $17988.92, which includes sales of calls and puts and and selling the stock.

You can see that I have debits of $27898.00 which means that I have spent $27898 on this stock in the time I’ve been tracking it.

My adjusted cost basis for this stock is $8.55. Which means that if I sold it all at $8.55 higher (since I own 1100 shares right now), I would break even overall.

Let’s look at two more.

First, CCL 0.00%↑ I have bought and sold a few times and you can see by the image below that I although I don't own any shares right now, I am ahead on this stock overall.

Second, AMC 0.00%↑ I have owned as well. With AMC, I sold it at a large loss, and made a few bad decisions.

I don’t own any AMC 0.00%↑ right now and still I lost money overall on it.

Considering how far AMC has fallen since I did own it, the fact I’m out only $2200 is something I am grateful for.

Just to compare these numbers to my managed 401K, it dropped 40% and there is no method for me to bring that up right now.

Hope this helps. Just a friendly reminder that this is not investment advice, but just sharing my learning. I’d love to hear what you think about this and how your own progress is going.